Aging at Home: Cash-for-Care Models Reduce Institutionalization

Economic Note on the European models that provide seniors with added autonomy, leading to more independence, better health, and better adjustment to increased care needs

Provincial governments in Canada should implement cash-for-care systems to encourage home care, while respecting taxpayers’ ability to pay, according to this publication from the MEI.

Related Content

Related Content

|

|

|

| Aging at home is not an impossible dream (Toronto Star, November 7, 2022)

Soins à domicile: Québec devrait s’inspirer de l’Allemagne et des Pays-Bas, estime l’IEDM (Le Journal de Montréal, November 7, 2022) |

Interview (in French) with Emmanuelle B. Faubert (L’Outaouais Maintenant, 104,7 FM, November 7, 2022) |

This Economic Note was prepared by Krystle Wittevrongel, Senior Policy Analyst and Alberta Project Lead at the MEI, and Emmanuelle B. Faubert, Economist at the MEI. The MEI’s Health Policy Series aims to examine the extent to which freedom of choice and entrepreneurship lead to improvements in the quality and efficiency of health care services for all patients.

Elder care in Quebec, and across Canada, is nearing a crisis. Seniors are having trouble accessing services, and the aging population will put immense pressure on the system. Moreover, while seniors overwhelmingly prefer to age at home, the care system in place has resulted in many being prematurely institutionalized.(1)

With a well-developed home care system, more seniors could receive care in their homes, reducing the dependence on institutionalization. One way to shift the focus from institutionalization to home care is through continuing-care policies and models that give patients a much larger say in what services they receive, and more importantly, where they receive them. “Cash-for-care” models, common across Europe, emphasize choice, consumer direction, the development of care markets, and market mechanisms.(2) Studies suggest that these models reduce the reliance on residential or institutional care.(3)

Fostering More Home-Based Care

Cash-for-care (CFC) models give purchasing power to long-term care (LTC) recipients through direct public transfers to support care at home. In contrast, LTC in Canada is mainly funded and organized from the perspective of care providers, and most users have very little control over where and how they receive services.(4)

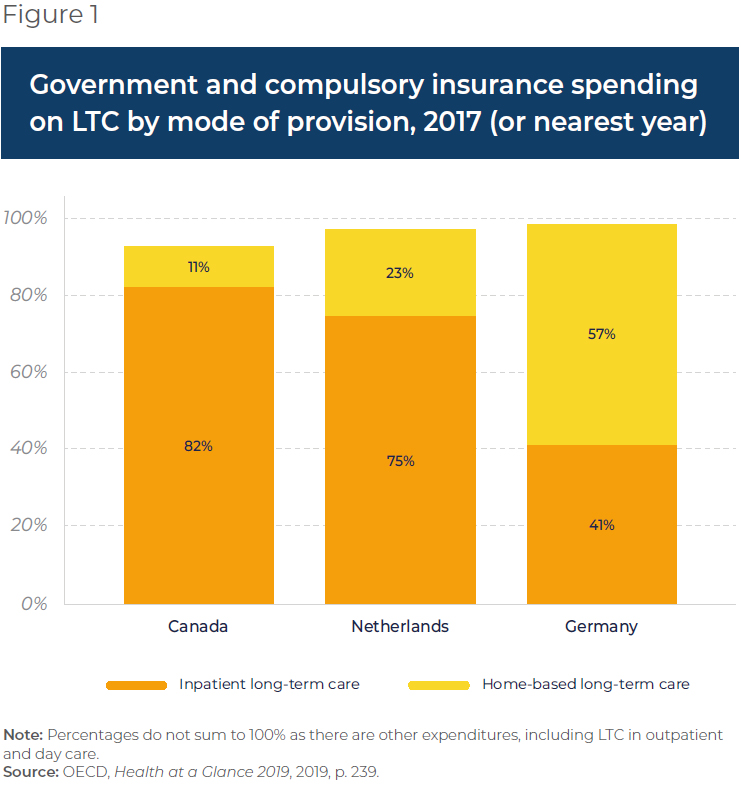

While CFC models vary from country to country, they generally involve monetary transfers that give individual users a choice in how to spend that budget, either by purchasing professional services or by compensating informal caregivers.(5) These transfers can take various forms: direct payments, care allowances, personal budgets, self-directed care, attendance allowances, or individual budgets.(6) In some countries where CFC is well developed, such as Germany and the Netherlands, there is relatively higher spending on home care, in contrast with Canada’s heavy institutional spending (see Figure 1).

Despite differences in policy details, CFC models across Europe aim to facilitate both formal and informal home care through patient choice and competition between providers.(7)

Ensuring Choice and Autonomy

One of the main principles of cash-for-care models is “free choice,” meaning that recipients can choose both the provider and the type of care. The choice of how, where, when, and by whom care is provided can be either explicit or implicit. In both Germany and the Netherlands, seniors can choose between in-kind services or cash to spend on the purchase of market services for their own care arrangements, including the compensation of informal caregivers.(8) However, there are regulatory distinctions regarding the use of the benefit that have had differing impacts in the two countries.(9)

In the German long-term care insurance system,(10) cash benefits can be transferred directly to seniors who then manage (with care coordinators) the organization of the care that best meets their needs.(11) Individuals who prefer the cash option, though, will receive a smaller subsidy than if they were to receive services, or care, in kind.(12) Research shows positive welfare effects for seniors following the introduction of this system in Germany, stemming from their added autonomy and greater self-determination.(13) In turn, greater self-determination leads to more independence, better health, and better adjustment to increased care needs.(14)

In contrast, the Netherlands requires a formal employment contract between recipient and caregiver.(15) This has contributed to a smaller proportion of recipients opting for cash payments compared to Germany,(16) likely leading to more restrained growth in informal markets for care. This may also explain why the proportion of overall spending on home care is higher in Germany. At the same time, though, as benefits in the Netherlands are quite generous,(17) most eligible seniors use less subsidized LTC than they are entitled to, regardless of supply.(18) As the system is well tailored to the needs of users, Dutch seniors’ needs are more likely to be taken care of at home unless institutionalization is a necessity.(19)

This contrasts with the situation in Quebec and across Canada, where there is little choice over the basket of services available,(20) and where home care support is lacking, leading to the over-institutionalization of the elderly. Indeed, it is estimated that relatives informally provide between 70% and 75% of the care required at home Canada-wide,(21) and a third of those providing informal care report being distressed.(22) According to Tracy Johnson, Director of Health System Analysis and Emerging Issues at the Canadian Institute for Health Information, “By improving home care services and community supports, caregivers could be better equipped to provide the proper care for those who wish to stay at home, and be less likely to be distressed.”(23) The ability to pay informal caregivers could help to alleviate some of their burden, encouraging them to continue providing care and thus avoiding unnecessary institutionalization.(24)

Developing Competitive Care Markets and Improving Access

Empowering seniors through choice not only enhances their autonomy; it also promotes and fosters competition within the care-giving sector itself, thus facilitating the expansion of care networks. In fact, one outcome of the CFC model is increased competition among care providers resulting from consumer-directed care.(25)

One goal of Germany’s LTC insurance system was to reduce the barriers to entry faced by for-profit home care providers, thus opening the market and allowing them to compete with the previously dominant non-profit LTC providers.(26) As services for both institutional and home care can be offered by a range of public, for‐profit, and non-profit providers, recipients can choose where and who will provide these benefits, which has led to competition for users.(27) As care providers can practise their profession in both the private and public sectors, receive formal training, and are paid directly by the state,(28) these formal markets have developed in both the Netherlands and Germany. In Germany in particular, there has been a significant rise in home care options and provider capacity since the inception of the LTC insurance system, especially from the for-profit private sector, the non-profit sector remaining relatively stable and the public sector remaining quite small(29) (see Figure 2).

Cash benefits, on the other hand, are often associated with informal and grey(30) markets that arise with the payment of informal caregivers. As mentioned, in the Netherlands, a formal contract must be signed by the informal caregivers, as well as a justification by the user about the use of benefits.(31) In contrast, the German market is much less regulated, and users are not required to justify their use of benefits, nor are there any systemic controls on their use.(32) However, while informal German caregivers can be paid by the recipient, the amounts are generally not enough to constitute their main source of income. This has led to the creation of a private care market outside the control of social and labour regulations (that is, a grey market) employing low-wage workers, often immigrants.(33)

Despite differences in their structures, the CFC models in both the German and Dutch systems provide choice to those receiving benefits. This has resulted in the opening of care markets and the creation of new forms of employment, and ultimately impacted the organization of care work.(34)

In Quebec, although a majority want to age at home, there are concerns about accessibility.(35) By allowing Quebec seniors to choose the care that best meets their needs, these models could improve access to care by increasing the number of options and providers. In Germany, substantial growth in the sector after the barriers to entry for private for-profit providers were reduced has increased access, adding over 250,000 new jobs to the care market.(36)

Risks to Consider and Mitigate

The German and the Dutch cases show that continuing-care policies and models, such as cash-for-care, give users flexibility, and a voice in how and where they receive care. They also indicate, however, that there are potential risks to increasing the proportion of home care in Canada using such models, related to quality control and the containment of public expenditures.

First, in unregulated markets such as Germany’s, the use of unqualified workers can lead to poor care quality, which can have significant impacts on the health of the recipients.(37) However, there are safeguards which can be implemented, even in an unregulated system, such as a training program for informal caregivers, covered by health insurance funds,(38) and the periodic visiting of care recipients to ensure their overall situation at home is adequate.(39) In the Dutch system, quality is enforced by requiring that caregivers be officially hired in order to be able to receive any sort of compensation and employment-related social rights.

Second, while containing costs is an implicit aim for many of the cash-for-care models in Europe,(40) the issue of expenditure growth with increased access and uptake cannot be ignored. The CFC models in both the Netherlands and Germany were implemented in response to aging populations and to prior policies that were both costly and unresponsive.(41) Countries with better-developed home care do have the tendency to experience lower public expenditures in the long run. Indeed, evidence from multiple jurisdictions shows a decline in spending and long-term cost savings following the expansion of home and community care, since home care is generally more cost-effective than institutional care.(42)

However, evidence on the short-term impact of CFC models on public expenditures is mixed.(43) There might be short-term increases in spending due to the implementation of a CFC model.(44)

For example, when the Netherlands first adopted its CFC system in the 1990s, the basket of goods was very broad in scope and in entitlements, leading to a sharp increase in public costs for CFC benefits. Multiple reforms were needed in order to reel in expenditures.(45) This resulted in the provision of institutional care to those who need it most versus those who can age at home, and there was an 86% decrease in seniors requiring low levels of care in institutions between 2015 and 2019.(46)

By having more defined “basic needs,” Germany has been better able to keep a lid on expenditures. Special attention should thus be paid to the definition and scope of CFC benefits during the implementation phase.

Conclusion

Through the intentional focus on enhancing choice, developing care markets, and market mechanisms,(47) cash-for-care models can foster the development of home care and reduce the reliance on residential or institutional care.(48) While not all CFC models are created equal, there is no need to reinvent the wheel. Public authorities in Quebec and elsewhere in Canada should look at how such models work in countries such Germany or the Netherlands, in order to allow more seniors to age at home.

References

- Maria Lily Shaw, “Spending Your Golden Years at Home: Developing Home Care Services in Quebec,” MEI, Economic Note, October 2022, p. 1.

- Barbara Da Roit, Blanche Le Bihan, and August Österle, “Cash-for-care benefits,” in Cristiano Gori, Jose-Luis Fernandez, and Raphael Wittenberg (eds.), Long-term Care Reforms in OECD Countries, Policy Press, 2015, pp. 143- 144; Barbara Da Roit and Blanche Le Bihan, “Similar and Yet So Different: Cash-for-Care in Six European Countries’ Long-Term Care Policies,” The Milbank Quarterly, Vol. 88, No. 3, 2010, p. 287; Emmanuele Pavolini and Costanzo Ranci, “Restructuring the welfare state: reforms in long-term care in Western European countries,” Journal of European Social Policy, Vol. 18, No. 3, 2008, pp. 254-255.

- Eva Pattyn et al., “The impact of cash-for-care schemes on the uptake of community-based and residential care: A systematic review,” Health Policy, Vol. 125, No. 3, 2021, pp. 371-372.

- While there are tax credits in QC to support home-care (tax credits for home- support services, home-support devices, and caregivers, for example), these are difficult to navigate and relatively underutilized. Maria Lily Shaw, op. cit., endnote 1.

- Barbara Da Roit and Blanche Le Bihan, “Cash for long‐term care: Policy debates, visions, and designs on the move,” Social Policy & Administration, Vol. 53, No. 4, 2019, p. 519.

- Barbara Da Roit, Blanche Le Bihan, and August Österle, op. cit., endnote 2, p. 144.

- Ibid., pp. 143-144; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 299. In Germany, for instance, the model is based on several legal principles that include autonomy, the prioritization of home care, personal responsibility, and societal responsibility, as stated in Natasha Curry, Laura Schlepper, and Nina Hemmings, What can England learn from the long-term care system in Germany? Nuffield Trust, September 2019, p. 9.

- Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 5, p. 519. Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 286.

- Ito Peng, “Long-term care insurance would better serve Canada’s aging population,” Policy Options, May 20, 2021; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, pp. 288-290.

- The LTC system in Germany is organized and financed as a model of social insurance. This means: “The entire resident population is obliged to pay compulsory insurance contributions for LTC and is entitled to benefits from the LTC insurance scheme. Even though the entitlement to benefits is quite comprehensive, LTC insurance may only cover part of the costs of long-term care. The rest is covered by people in need of LTC themselves or—if necessary and under certain conditions—by immediate family members or social assistance.” This contrasts with Canada, where LTC is considered an extended health service and is paid for out of the public purse by all taxpayers. The Social Protection Committee (SPC) and the European Commission (DG EMPL), 2021 Long-term care report: Trends, challenges and opportunities in an ageing society, Country Profiles, Vol. 2, 2021, p. 70; Joan Costa-Font, Christophe Courbage, and Katherine Swartz, “Financing Long-Term Care: Ex Ante, Ex Post, or Both?” Health Economics, Vol. 24, 2015, p. 54.

- Åke Blomqvist and Colin Busby, “Shifting Towards Autonomy: A Continuing Care Model for Canada,” C.D. Howe Institute, Commentary, No. 443, January 2016, p. 6.

- The value of cash benefits in the Netherlands is also lower than that of services or care in-kind. Ibid., p. 9; OECD, “Netherlands: Long-term Care,” May 18, 2011, p. 1.

- Valentina Zigante, “Chapter 3: Choice—Does Choice Improve Subjective Well- Being? The Case of German Long-term Care Provision,” in Consumer Choice, Competition and Privatization in European Health and Long-Term Care Systems: Subjective Well-Being and Equity Implications, Ph.D. thesis, London School of Economics and Political Science, December 2013, pp. 143-146.

- Seniors First BC, Autonomy vs Dependence for Older Adults, consulted October 16, 2022.

- European Commission, Directorate-General for Employment, Social Affairs and Inclusion, Zigante, V., Informal care in Europe: Exploring Formalisation, Availability and Quality, Publications Office, April 2018, pp. 26-27.

- Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, Table 2.

- Marianne Tenand, Pieter Bakx, and Eddy van Doorslaer, “Equal long-term care for equal needs with universal and comprehensive coverage? An assessment using Dutch administrative data,” Health Economics, Vol. 29, 2020, p. 436.

- Ibid., p. 447.

- Claudine de Meijer et al., “Explaining declining rates of institutional LTC use in the Netherlands: A decomposition approach,” Health Economics, Vol. 24, 2015, p. 29.

- Yanick Labrie, Rethinking Long-Term Care in Canada: Lessons on Public- Private Collaboration from Four Countries with Universal Health Care, Fraser Institute, October 2021, pp. 3-7.

- Health Council of Canada, Seniors in need, caregivers in distress: What are the home care priorities for seniors in Canada? April 2012, p. 30.

- Canadian Institute for Health Information, “1 in 3 unpaid caregivers in Canada are distressed,” August 6, 2020.

- Idem.

- Max Geraedts, Geoffrey V. Heller, and Charlene A. Harrington, “Germany’s Long-Term-Care Insurance: Putting a Social Insurance Model into Practice,” The Milbank Quarterly, Vol. 78, No. 3, 2000, pp. 376-377.

- Monique Kremer, “Consumer in Charge of Care: The Dutch Personal Budget and Its Impact on the Market, Professionals and the Family,” European Societies, Vol. 8, No. 3, 2006, p. 388.

- Joanna Marczak and Gerald Wistow, “Commissioning long-term care services,” in Cristiano Gori, Jose-Luis Fernandez, and Raphael Wittenberg (eds.), Long-term Care Reforms in OECD Countries, Policy Press, 2015, p. 123.

- Idem.

- German Federal Ministry of Health, Long-Term Care Guide: Everything you need to know about long-term care, February 2020, pp. 57-58.

- Heinz Rothgang et al., “Pflegereport 2017: Schriftenreihe zur Gesundheitsanalyse,” Barmer, 2017, as cited in World Health Organization, Germany: Country case study on the integrated delivery of long-term care, Regional Office for Europe, 2020, pp. 25-26.

- Gray markets in the context of CFC models refer to “paid providers who are unrelated to the recipient, not working for a regulated agency, and potentially unscreened and untrained.” In Europe, this is often related to immigrant labour from neighbouring countries. Rand Corporation, “Nearly a Third of Americans Use Gray Market When Hiring Caregivers for the Elderly and Those with Dementia,” June 21, 2021.

- Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 302.

- However, an agency in Germany does periodically review the care arrangements of those receiving cash benefits through the assessment and review of user circumstances. Barbara Da Roit, Blanche Le Bihan, and August Österle, op. cit., endnote 2, p. 151; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, pp. 299-301.

- Benjamin W. Veghte, Designing Universal Long-Term Services and Supports Programs: Lessons from Germany and Other Countries, National Academy of Social Insurance, 2021, p. 26; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 302.

- Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 302.

- Réseau de coopération des EÉSAD, “Soutien à domicile – Chez moi pour la vie, le choix des québécois selon un sondage Léger,” press release, February 17, 2021.

- Pamela Nadash, Pamela Doty, and Matthias von Schwanenflügel, “The German Long-Term Care Insurance Program: Evolution and Recent Developments,” The Gerontologist, Vol. 58, No. 3, 2018, p. 594.

- Juliette Malley, Birgit Trukeschitz, and Lisa Trigg, “Policy instruments to promote good quality long-term care services,” in Cristiano Gori, Jose-Luis Fernandez, and Raphael Wittenberg (eds.), Long-term Care Reforms in OECD Countries, Policy Press, 2015, p. 168.

- European Commission, op. cit., endnote 15, p. 32.

- Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, pp. 299-301.

- Barbara Da Roit, Blanche Le Bihan, and August Österle, op. cit., endnote 2, p. 160.

- Ito Peng, op. cit., endnote 9; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 286.

- Marcus J. Hollander et al., “Increasing Value for Money in the Canadian Healthcare System: New Findings and the Case for Integrated Care for Seniors,” Healthcare Quarterly, Vol. 12, No. 1, 2009, p. 39.

- Joanna Marczak and Gerald Wistow, op. cit., endnote 26, p. 129.

- H. Stephen Kaye, Mitchell P. LaPlante, and Charlene Harrington, “Do Non-Institutional Long-term Care Services Reduce Medicaid Spending?” Health Affairs, Vol. 28, No. 1, 2009, pp. 270-271.

- Peter Alders and Frederik T. Schut, “The 2015 long-term care reform in the Netherlands: Getting the financial incentives right?” Health Policy, Vol. 123, No. 3, March 2019, p. 312.

- Idem; Yanick Labrie, op. cit., endnote 20, p. 29.

- Barbara Da Roit, Blanche Le Bihan, and August Österle, op. cit., endnote 2, pp. 143-144; Barbara Da Roit and Blanche Le Bihan, op. cit., endnote 2, p. 296; Emmanuele Pavolini and Costanzo Ranci, op. cit., endnote 2, pp. 254-255.

- Eva Pattyn et al., op. cit., endnote 3, pp. 371-372.