The Most Efficient Way to Stimulate the Economy: Private Pipelines or Public Infrastructure?

The public debates over pipelines have focused especially on their safety, on environmental risks, and on economic spinoffs. These are relevant questions, but they are often considered from a local point of view instead of from a pan-Canadian perspective. This Economic Note examines the four pipeline projects currently being studied and focuses on their economic impact for Canada as a whole by contrasting them with the effects of public infrastructure investment.

Media release: Stimulating the economy with private pipeline projects rather than with public deficits

Links of interest

Links of interest

|

|

|

|

Des déficits ou des oléoducs? (La Presse+, June 9, 2016)

Pipeline Stimulus (National Post, June 9, 2016) |

Interview (in French) with Youri Chassin (Le café show, Radio-Canada, June 9, 2016) | Interview with Joe Oliver (Business Day AM, BNN-TV, June 9, 2016) |

The Most Efficient Way to Stimulate the Economy: Private Pipelines or Public Infrastructure?

Currently, the promoters of four pipeline projects in Canada and the United States are at various stages in the process of trying to transport oil produced in Alberta. These projects represent considerable private investments totalling over thirty billion dollars in Canada, at a time when the federal government is predicting a deficit of around the same amount for this year in the hope of stimulating the economy through infrastructure spending.

The public debates over pipelines have focused especially on their safety, on environmental risks, and on economic spinoffs. These are relevant questions, but they are often considered from a local point of view instead of from a pan-Canadian perspective. This Economic Note examines the four pipeline projects and focuses on their economic impact for Canada as a whole by contrasting them with the effects of public infrastructure investment.

The Pipeline Projects Currently Being Studied

The National Energy Board (NEB) already regulates 73,000 km of oil and gas pipelines that criss-cross the country, from Vancouver to the Atlantic Provinces.(1) This network has been in development since 1853, when the first gas pipeline transported natural gas to Trois-Rivières to light the streets.(2)

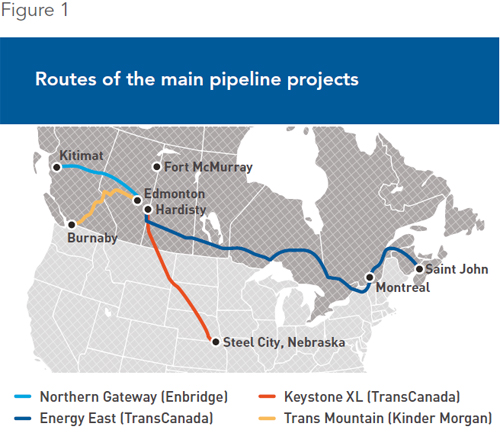

The four projects being studied, all at different stages, offer outlets for oil produced in Alberta by connecting the province to ports on the east and west coasts, or in the case of the Keystone XL project, to the American market (see Figure 1).

Energy East (TransCanada)

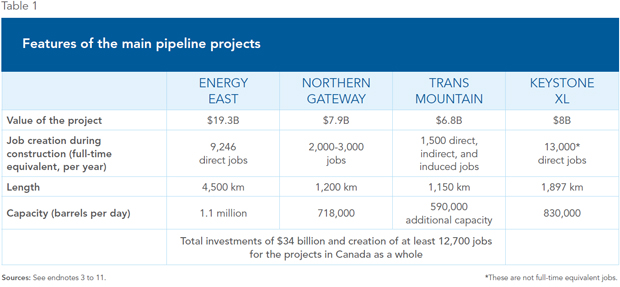

The Energy East project involves the conversion of a 3,000-km gas pipeline connecting Alberta and Ontario, and the construction of a new 1,500-km structure to Saint John, New Brunswick. This approximately 4,500-km structure will transport 1.1 million barrels per day between Hardisty, Alberta and Saint John and will require an estimated investment of $19.3 billion.(3)

Northern Gateway (Enbridge)

Enbridge’s Northern Gateway project involves two pipelines that would connect Bruderheim, Alberta with Kitimat, British Columbia. In total, the project would allow for the transport of 718,000 barrels per day over a route of a little under 1,200 km. The construction of these pipelines would necessitate an investment of $7.9 billion.(4) The federal government approved the project in 2014, imposing 209 conditions, including particular attention to the concerns of aboriginal communities.

Trans Mountain (Kinder Morgan)

The Trans Mountain project involves doubling a network that has existed since 1953 including 1,150 km of pipeline connecting Edmonton with various terminals in British Columbia and Washington State. The addition of around 980 km of pipeline and the return to service of 193 km of existing pipeline would bring the transport capacity of Trans Mountain from 300,000 barrels per day to 890,000. This infrastructure requires an estimated investment of $6.8 billion.(5) The NEB is recommending that the government approve the project, with 157 conditions.(6)

Keystone XL (TransCanada)

The 1,897-km pipeline connecting Hardisty, Alberta to Steele City, Nebraska could transport up to 830,000 barrels of oil per day. In Canada, 529 km of pipeline would be built.(7) The Keystone project includes several phases that already exist, the first of which began operating in June 2010 following a different route. The capacity of the preceding phases is limited to 591,000 barrels of oil per day.(8) The Keystone XL project was rejected by the President of the United States in November 2015. In January 2016, TransCanada decided to take the matter to court under the North American Free Trade Agreement to contest this decision and obtain compensation.(9) The project was evaluated at $8 billion, an amount that would however be spent mainly in the United States.(10)

A Major Economic Impact

In all, these projects represent substantial investments totalling $34 billion, excluding the Keystone XL project located largely in the United States. During construction of the pipelines in Canada, various estimates find that between 12,700 and 21,500 jobs will be created across nearly every Canadian province, from British Columbia to New Brunswick (see Table 1).(11) The main benefit of these pipeline projects is not the creation of jobs, however, since they are capital-intensive infrastructure, and not labour-intensive. Nonetheless, these jobs would be all the more welcome given that some 40,000 have been lost in the energy sector in Alberta with the fall in oil prices.(12)

In the case of Eastern Canadian refineries located in Montreal, Lévis, and Saint John, the ability to supply themselves with oil on the Canadian market improves their long-term prospects. Beyond refineries, the petrochemical industry (the polyester production chain in Montreal’s east end, for instance) also depends on competitively priced supplies.(13) These industries and the jobs connected to them would be more secure.

The main benefit of pipelines is the opening up of access to the global market for oil from the Prairies, allowing producers to obtain a higher price than they currently do. As long as the United States is the only export market for Canadian oil, this sector is dependent on a market which is itself producing more and more oil. The price differential for a barrel of oil on the internal American market versus on the world market implies a loss of revenues for governments, as well as a loss for the Canadian economy that can be estimated at $13.5 billion.(14)

The major economic impact of these investments can only be appreciated from a pan-Canadian perspective. These projects cross different provinces or states, and thousands of municipalities and aboriginal communities, but it would be misleading to consider only the costs and benefits at a strictly local level. Indeed, no community crossed by a pipeline, other than those where there are refineries that benefit from this supply, will see any substantial economic spinoffs once the construction phase is completed. Like a lot of other infrastructure—highways, for example—once built, they are used without the need to operate them on site.

Even though the municipalities concerned do not all reap significant direct economic benefits on their territory, this in no way prevents such large projects from being economically positive from a pan-Canadian perspective. It is from this broader point of view that they must be evaluated.

Projected Infrastructure Spending in the 2016 Federal Budget

In the hope of stimulating the economy, the federal government announced in its 2016 Budget a total of $120 billion devoted to infrastructure over the next 10 years, which is $60 billion more than projected by the previous government. These amounts are in addition to the sums earmarked for the maintenance of federal assets.(15)

However, for the year in progress, the real funding devoted to infrastructure represents just $3.97 billion, the equivalent of 13.5% of the projected deficit of $29.4 billion. Several expenditures are considered infrastructure investments, but are not really so: affordable housing, early learning and child care, cultural and recreational infrastructure, climate change mitigation and adaptation for municipalities, etc.(16) These expenditures, whether or not they are socially desirable, do not constitute investments in economic infrastructure. Similarly, the proportion of the $120 billion that will actually be devoted to investments in economic infrastructure remains uncertain.

The amounts really dedicated to boosting the economy are therefore small, and their effectiveness in stimulating the economy is questionable because of another factor: The federal government stipulates that this spending will not be concentrated in provinces where the economy is shrinking and where unemployment is increasing.(17) Yet if a province’s economy is not shrinking, and on the contrary is operating close to its full potential, then it is in theory already using its productive factors adequately. Public spending will therefore merely displace resources—workers who would otherwise have been employed elsewhere, for example. In this case, no jobs will be created by the new spending, whose economic impact will be negative if companies are deprived of specialized or hard-to-replace labour.

The Respective Economic Effects of Public and Private Spending

The Canadian Finance Minister estimates that the additional infrastructure spending will boost the economy by 0.2% this year and 0.4% next year.(18) These projections must be treated with caution, however, given certain reservations about the economic efficiency of spending that is described as infrastructure investment.

The economic impact of private investment and public investment differ markedly, for four main reasons.

First, the creation of value is the whole purpose of private investment. As for public investment, it is mostly aimed at fulfilling promises of job creation, and its purpose is first and foremost political. These projects are directed by officials and civil servants according to criteria that are less economic in nature. The example of road infrastructure investment in Quebec shows that the ridings considered to be strongholds by the party in power receive more than their fair share as a reward for their loyalty.(19)

Second, public investments should, at least in theory, result in useful infrastructure and include economic benefits for certain communities. However, empirical results from the United States show that after 10 years, economic stimulus has no permanent effect on productivity.(20) Even in the short term, public spending can only create jobs in the public sector, and no lasting employment in the private sector.(21) In contrast, when the government competes less with the private sector in the recruitment of workers and the use of capital, private investment takes over.(22) Public spending cuts would therefore have positive effects on economic growth, as shown in a study of Canada in the 1990s carried out by renowned Harvard economist Alberto Alesina and two of his colleagues.(23)

Third, public infrastructure investment projects regularly run into difficulties, like cost overruns and delays. A project can therefore appear very positive for the economy on the basis of its estimated cost, the government’s ability to borrow at low rates to finance it, and a community’s interest in a local public good. However, if the project is poorly planned, and costs end up being higher than projected or implementation delays too long, the positive impact can be considerably reduced, or can even disappear altogether. This kind of risk is implicitly guaranteed by taxpayers for all public investment projects.

Fourth, public infrastructure is funded either by raising Canadians’ tax burden or by growing the public debt that is supported by taxpayers. In contrast, private investment does not require tax money since it is private companies that run the projects with their own funds. The economic activity generated by this private investment will even contribute to governments’ tax revenue while using very little in the way of public services. Taxpayers are therefore spared all while benefiting from a more vigorous economy and from job creation.

Conclusion

Private investment is clearly preferable to public spending, even on infrastructure, in terms of stimulating the economy. Pipeline projects, in particular, represent substantial economic benefits when considered from a Canadian perspective, and not solely in terms of local spinoffs.

Justin Trudeau has pointed out that pipelines represent the safest way of transporting oil, and that ensuring market access for Canadian resources was one of the most important duties of a Prime Minister.(24) Concretely, it is possible for the federal government to encourage private investment by ensuring that these four projects go forward.

For example, intelligent regulation must include delays that are predictable—and as short as possible—so that developers know what to expect. Clear definitions of federal, provincial, and municipal jurisdiction would also help to remove uncertainty. Recent changes seem to go in the opposite direction by opening the door to regulatory duplication, study mandates that are too broad, and additional delays.(25) By resolving these irritants, the federal government would encourage projects that do a better job of stimulating the Canadian economy than infrastructure spending, all without hurting our public finances.

This Economic Note was prepared by the Honourable Joe Oliver, former Minister of Natural Resources and of Finance, and Distinguished Senior Fellow at the Montreal Economic Institute, and Youri Chassin, Economist and Research Director at the MEI. The MEI’s Energy Series aims to examine the economic impact of the development of various energy sources and to challenge the myths and unrealistic proposals related to this important field of activity.

References

1. Natural Resources Canada, Frequently Asked Questions (FAQs) Concerning Federally-Regulated Petroleum Pipelines in Canada, 1.3 How extensive is Canada’s pipeline system? March 8, 2016.

2. Ibid., 1.2 How long have pipelines been used to transport oil and gas in Canada?

3. TransCanada, Project Application Documents, Volume 1: Application and Project Overview, “Executive Summary: Section 1,” May 2016, p. 1-1.

4. National Energy Board, Considerations : Report of the Joint Review Panel for the Enbridge Northern Gateway Project—Volume 2, 2013, pp. 2-3.

5. Trans Mountain, Proposed Expansion; National Energy Board, National Energy Board Report: Trans Mountain Expansion Project, May 2016, pp. 1, 2, and 262.

6. National Energy Board, “NEB report recommends conditional approval of the Trans Mountain Expansion Project,” Press release, May 19, 2016.

7. TransCanada, About the Keystone XL Pipeline.

8. TransCanada, Keystone Pipeline Starts Deliveries to U.S. Midwest, June 2010.

9. Counsel for TransCanada Corporation and TransCanada PipeLines Limited, Notice of intent to submit a claim to arbitration under Chapter 11 of the North American Free Trade Agreement, January 6, 2016, pp. 3 and 27.

10. Michael Bird, “A look at major pipeline project proposals in Canada,” The Globe and Mail, December 2, 2014.

11. In December 2014, the National Post compiled the companies’ statements on expected employment and arrived at 21,500 jobs during the construction phase, not including Keystone XL jobs. See Yadullah Hussain, “Missing the big picture: Pipelines create jobs, but what they really do is boost the economy,” National Post, December 5, 2014. Our own compilation of the companies’ most recent estimates, solely for direct employment when possible, is based on the following sources: Trans Mountain, “Local businesses in Burnaby would be winners with Trans Mountain Expansion Project,” July 15, 2015; Northern Gateway, One of the largest private infrastructure projects in B.C. history; TransCanada, Supporting and Strengthening our Provinces.

12. Ian Bickis, “2015 worst year for Alberta jobs losses since 1982,” The Canadian Press, January 26, 2016.

13. Jean-François Minardi, “The Economic Benefits of Pipeline Projects to Eastern Canada,” Economic Note, MEI, August 2013.

14. The calculation of this estimate and the hypotheses upon which it is based are presented in the Technical Annex to this Economic Note, available on the MEI’s website.

15. Government of Canada, Budget 2016: Growing the Middle Class, March 22, 2016, p. 86; Government of Canada, Budget 2015: Strong Leadership—A Balanced-Budget, Low-Tax Plan for Jobs, Growth and Security, April 21, 2015, p. 189.

16. The amount of $3.97 billion represents spending in 2016-2017 on a cash basis, not on an accrual basis. Ibid., 2016, pp. 48, 90, and 255.

17. Bill Curry et al., “The $125-billion question,” The Globe and Mail, March 21, 2016.

18. Drew Hasselback, “Federal budget 2016: Liberals to spend $11.9 billion on infrastructure over two years,” National Post, March 22, 2016.

19. This result refers only to projects carried out between 1986 and 1996, because since then, the data have not been made public. Marcelin Joanis, “The Road to Power: Partisan Loyalty and the Centralized Provision of Local Infrastructure,” Public Choice, Vol. 146, Nos. 1-2, January 2011, pp. 117-143.

20. Sylvain Leduc and Daniel Wilson, “Roads to Prosperity or Bridges to Nowhere? Theory and Evidence on the Impact of Public Infrastructure Investment,” NBER Working Paper No. 18042, May 2012.

21. Valerie A. Ramey, “Government Spending and Private Activity,” in Alberto Alesina and Francesco Giavazzi (eds.), Fiscal Policy after the Financial Crisis, University of Chicago Press, June 2013, pp. 19-55, cited in Mathieu Bédard, “The Federal Government’s Deficits Will Not Stimulate the Canadian Economy,” Viewpoint, MEI, March 2016.

22. António Afonso and João Tovar Jalles, “Assessing Fiscal Episodes,” Economic Modelling, Vol. 37, February 2014, pp. 255-270, cited in Mathieu Bédard, ibid.

23. Alberto Alesina, Carlo Favero and Francesco Giavazzi, “The Output Effect of Fiscal Consolidation Plans,” Journal of International Economics, Vol. 96, 2015, Figure 2, pp. S19-S42, cited in Mathieu Bédard, op. cit., endnote 21.

24. Devin Henry, “Trudeau supports pipelines, but wants ‘responsible’ energy production,” The Hill, March 31, 2016; Joël-Denis Bellavance, “Justin Trudeau à La Presse sur les oléoducs: ‘Ça ne va pas faire l’unanimité’,” La Presse, February 11, 2016.

25. Raphaël Bouvier-Auclair, “Ottawa annonce des normes transitoires d’évaluation des projets d’oléoducs,” ICI Radio-Canada.ca, January 27, 2016.